Price Risk Management

Interested in Hedging Product Price Risk?

Most commodity products have high price volatility. The ill-effects of that volatility can be limited through the use of price-risk management tools, offered by banks, brokers and exchanges. Metals, agricultural products and most energy products have for years had an active price risk management market. Commodity products linked to the forest products industry have recently joined this development.

In the old times, price discovery, and with it the trading, were based on a physical delivery concept. If you did not like the price on the settlement date, you delivered or received the product itself. Nowadays, more and more products in exchanges (futures, options and other such derivatives) are traded on cash settlement basis. The so-called OTC (over-the-counter) products offered by the banks are also cash-settled. For cash-settled price risk management products, reliable indices are needed. Those indices have several other uses, too.

The key to any successful derivatives market is a strong and reliable index. Market participants must have faith and trust in the Index and it must reflect actual market prices. The majority of commodity markets have massive, liquid, derivatives (financial) markets which trade multiples of the actual physical products. Examples would be Oil, Gas, Coal, Copper, Gold etc. The producers and consumers are able to use these markets to protect, manage, secure and reduce risk on the price volatility of the physical commodity. Price hedging can be from the short term of a few months, all the way through to 5 years or even longer.

FOEX PIX indices are used as benchmarks for price risk management tools by banks, brokers & other financial institutions (OTC-SWAPS) and by exchanges.

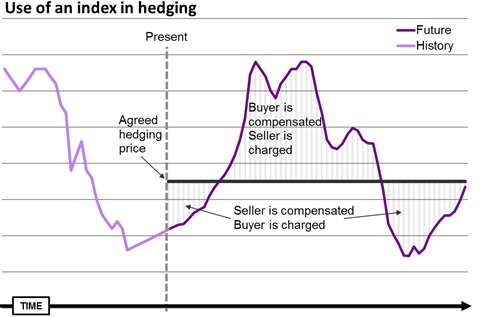

The graph above describes the basic principles of price risk hedging, where the market price index tracks the price development of the physical commodity, and triggers compensation between the hedging client and the bank/financial institution providing hedging services.

While the traders of derivatives are taking a risk by ‘putting their money on the table’, the industry can use these future prices to reduce risk. For the commodity market, traders will look at the fundamentals of the underlying market as well as the macro economic picture in trying to predict what will happen to prices going forward. Prices are then quoted as an average Index price over the term of the contract, valued against the Index price at each agreed settlement.

At its very core, the benefit of using an Index to hedge prices is that one can replace unknown prices in the future, with known prices today for business exposure in the future. Most commodity products have high price volatility. The use of price risk management can be seen as an insurance against the ill-effects of that volatility.

NOREXECO

The NOREXECO Exchange is a Pulp & Paper derivatives exchange that will provide a transparent, efficient, and regulated market place for pulp futures contracts allowing exchange members to optimize their price exposure.

All futures contracts are cash settled against FOEX PIX indices and cleared by ECC (European Commodity Clearing AG). The products listed include PIX NBSK Europe, PIX BHKP Europe and PIX OCC 1.04 dd.

The NOREXECO Exchange provides equal conditions for all member participants, and is supported by an increased amount of global pulp and paper participants, mainly due to the benefits of:

- No credit risk

- Full anonymity

- Low transaction cost

- Increased transparency

The NOREXECO Trading Platform is provided by Deutsche Börse AG.

For further information please contact: Anita Skjong, +47.4144.0097, as(at)norexeco.com

Please visit our website at: www.norexeco.com

Skandinaviska Enskilda Banken - SEB

SEB offers a full range of commodity services for managing commodity exposures both from a risk management and investor perspective. Our reach in commodities covers all the major sectors - from energy and agricultural commodities to industrial and precious metals. Our advisory driven approach is based on extensive analysis and understanding of our customer's business processes as well as market fundamentals.

We are also an active counterparty in pulp markets. Please do not hesitate to contact us for further information.

Finland: Jussi Lepistö, +358 9 6162 8521, jussi.lepisto(at)seb.fi

Sweden: Niclas Egmar, +46 8 506 23455, niclas.egmar(at)seb.se

OP Corporate Bank

OP Corporate Bank is a Finnish financial services group whose mission is to promote the sustainable prosperity, security and well-being of its customers. OP provides its corporate and institutional customers with a diverse range of banking, non-life insurance and asset management services, and private individuals with an extensive range of non-life insurance and private banking services.

Regarding commodity derivatives OP Corporate Bank is active market participant in a wide variety of underlyings including: Pulp, Oil products, Coal, Base Metals, Carbon emissions, Agriculturals and Plastics. OP Corporate Bank offers its clients commodity price risk management services with instruments like otc swaps, forwards and options. These Derivative instruments offered enable clients to reshape their commodity price risk profiles in order to support client's core business activities. For further information pls contact hyodykemyynti(at)op.fi or call +358 10 252 4295

StoneX (formerly INTL FCStone)

StoneX Group Inc. (NASDAQ:SNEX), through its subsidiaries, is a leader in the development of specialized financial services in commodities, securities, global payments, foreign exchange and other markets. Working from 40 offices across 15 countries, we help our clients access markets efficiently, manage their risk, and improve their bottom lines.

With access to more than 30 exchanges worldwide, StoneX is a leader in the energy, agriculture, metals, and FX markets. Directly or through our sister companies, we provide clearing, execution and risk management advisory services in pulp and paper futures, pulp and paper OTC products and related currency markets. We also offer in-depth pulp and paper market news and analysis, including weather information, and FX commentary.

Please do not hesitate to contact us for more information.